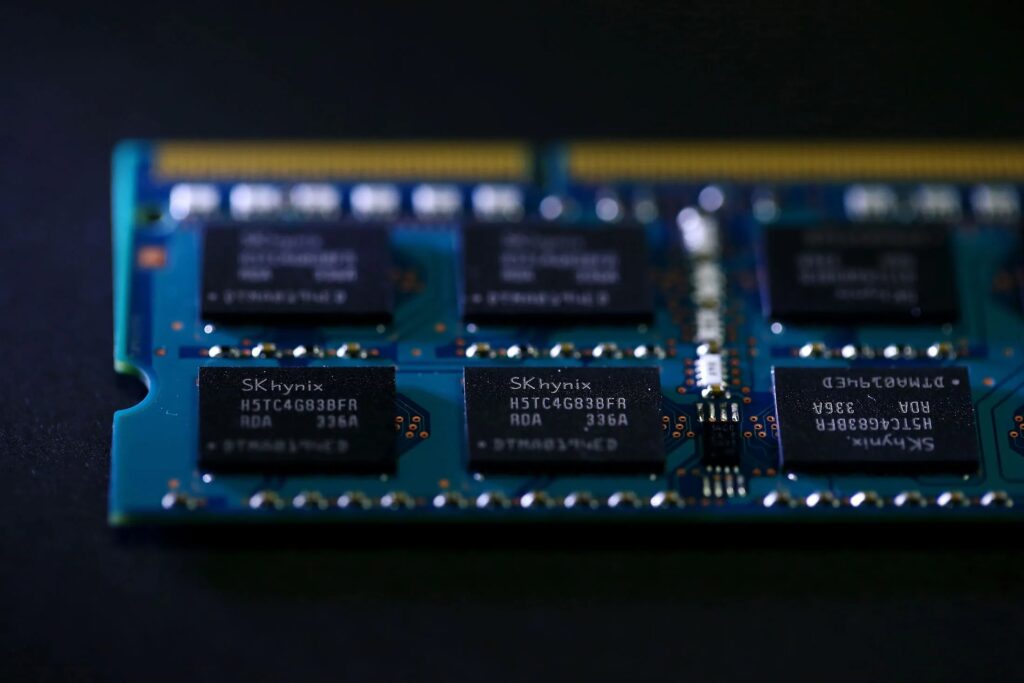

US Clears SK Hynix Chipmaking Tools to China in 2026

The U.S. government just gave Samsung and SK Hynix chipmaking operations a lifeline. Washington approved annual export licenses that let both companies keep shipping critical manufacturing equipment to their China factories through 2026.

CNBC reports that the U.S. Department of Commerce granted one-year licenses covering SK Hynix chipmaking facilities in China. This keeps critical American-made equipment flowing to Chinese fabs even as export controls tighten.

For SK Hynix chipmaking operations, this matters enormously. China accounts for a massive portion of the company’s memory production. Without access to U.S. tools, SK Hynix chipmaking capacity would face serious problems.

What the US Actually Approved

The U.S. Department of Commerce approved annual licenses for two major memory makers. Samsung Electronics gets approval for its NAND flash fabs in Xi’an and other Chinese facilities. SK Hynix chipmaking operations get licenses for DRAM production in Wuxi and NAND facilities in Dalian.

MarketScreener notes that these licenses allow U.S.-made chipmaking equipment and parts to ship to China fabs throughout 2026. This includes lithography tools, etching equipment, deposition systems, and metrology instruments.

The new system replaces earlier broad exemptions called “validated end user” status. Those waivers expire on December 31, 2025. After that, SK Hynix chipmaking facilities must work under the new annual license system.

Both Samsung and SK Hynix chipmaking divisions declined to comment on the licenses. The U.S. Department of Commerce hasn’t officially detailed the terms beyond background briefings.

Why China Matters for SK Hynix Chipmaking

China is absolutely critical for SK Hynix chipmaking operations. The company’s Wuxi fab produces a large share of its DRAM output. DRAM is the memory that powers everything from PCs to smartphones to data centers.

SK Hynix chipmaking facilities in Dalian contribute substantially to global NAND flash production. NAND is the storage memory in SSDs, USB drives, and smartphones. Edvigo reports that China accounts for up to 40-45% of SK Hynix’s NAND output.

Without access to U.S. tools, SK Hynix chipmaking operations would face immediate problems. Uptime would drop as worn tools couldn’t be replaced. Yields would decline as process windows drift without updated equipment. Output would fall, disrupting memory supply for tech products worldwide.

The annual licenses mean SK Hynix chipmaking operations in China can maintain planned capacity for 2025-2026. They don’t have to bet everything on last-minute waivers. This stabilizes a fragile memory supply chain at a time when AI and data centers demand more chips than ever.

From Broad Waivers to Annual Licenses

The approval comes against a shifting backdrop of U.S. export controls affecting SK Hynix chipmaking and other semiconductor companies.

October 2022 and 2023 Restrictions

In October 2022 and October 2023, the U.S. imposed sweeping restrictions on exporting advanced chipmaking tools to China. The goal was curbing China’s access to leading-edge semiconductors.

Samsung, SK Hynix chipmaking operations, and TSMC got temporary waivers. These validated end user exemptions let them continue upgrading and maintaining existing Chinese fabs without constant licensing.

September 2025 Revocation

News.az explains that in September 2025, the Trump administration revoked those broad waivers. The administration argued they were “too relaxed” and risked enabling Chinese technological advancement.

This put SK Hynix chipmaking operations in a difficult position. Without waivers, they’d need individual licenses for every equipment shipment. That could mean months of delays or outright denials.

The New Compromise

The annual license model is a compromise. It avoids a hard cutoff that would cripple SK Hynix chipmaking capacity in China. It also gives Washington tighter, recurring oversight over what tools reach Chinese facilities each year.

Instead of broad exemptions, SK Hynix chipmaking operations now work under yearly reviews. Every 12 months, they must return to Washington for renewed permission.

The Geopolitical Balancing Act

The decision reflects delicate geopolitical calculations affecting SK Hynix chipmaking and broader semiconductor policy.

Protecting US Tech Leadership

The U.S. wants to limit China’s access to high-end chipmaking tools. This is especially true for logic chips and advanced manufacturing nodes. Restricting SK Hynix chipmaking tool shipments helps achieve this goal.

Avoiding Supply Shocks

At the same time, Washington relies on Samsung and SK Hynix chipmaking capacity to supply memory for U.S. companies. American cloud providers, device makers, and AI infrastructure depend on these chips.

Cutting off SK Hynix chipmaking operations in China would create immediate memory shortages. Prices would spike. Data center expansions would stall. PC and smartphone production would face delays.

Supporting an Ally

South Korea is a key U.S. ally in Asia. An abrupt export freeze on SK Hynix chipmaking would undermine Seoul’s chip champions. It would also strain diplomatic ties at a time when the U.S. needs regional partners.

By allowing SK Hynix chipmaking equipment shipments under strict annual review, the U.S. keeps leverage over future technology flows. But it prevents near-term disruption in global memory markets.

What This Means for SK Hynix Chipmaking Strategy

The annual license system will shape strategic decisions at SK Hynix chipmaking operations going forward.

Investment Diversification

SK Hynix chipmaking facilities are already ramping memory capacity outside China. The company is expanding in South Korea, considering U.S. investments, and looking at other regions. The goal is reducing reliance on Chinese manufacturing over time.

Equipment Planning

SK Hynix chipmaking operations must now plan equipment upgrades in one-year approval cycles. This adds regulatory risk to long-term capital expenditure decisions. You can’t invest billions in a fab upgrade if you’re not sure next year’s license will come through.

Technology Boundaries

It remains unclear how advanced the tools covered by the licenses can be. The U.S. may cap certain extreme-ultraviolet lithography or next-generation deposition and etching equipment.

SK Hynix chipmaking operations will need to carefully manage which technologies they deploy in China versus keeping the most advanced processes in South Korea.

Industry Impact Beyond SK Hynix Chipmaking

This decision affects more than just SK Hynix chipmaking operations. It sets precedent for how the U.S. handles allied semiconductor companies with Chinese facilities.

Samsung faces the same annual review process for its Chinese NAND fabs. TSMC, though primarily focused on Taiwan, also has legacy operations in China that fall under similar scrutiny.

The message to the industry is clear: business can continue, but not on autopilot. Every year, companies like SK Hynix chipmaking divisions will return to Washington for renewed permission.

American tool suppliers also benefit. Companies like Applied Materials, Lam Research, and KLA get continued access to major customers’ Chinese facilities. Without these licenses, SK Hynix chipmaking operations might source more equipment from European or Japanese suppliers not subject to U.S. controls.

What Happens Next

For 2026, SK Hynix chipmaking operations in China have certainty. The annual licenses provide a clear path forward for maintaining and upgrading equipment.

But 2027 remains uncertain. Will the U.S. grant another year of licenses? Will restrictions tighten further? Will geopolitical tensions lead to harder lines on technology transfer?

SK Hynix chipmaking strategy must account for all these scenarios. The company is likely accelerating plans to shift cutting-edge production out of China. Legacy nodes and mature processes might remain in Chinese facilities under annual licenses.

Advanced nodes and next-generation technologies will increasingly concentrate in South Korea and potentially the United States if subsidies and partnerships materialize.

The Bottom Line

The U.S. approved annual export licenses letting Samsung and SK Hynix chipmaking operations ship critical manufacturing tools to China through 2026. This replaces expiring broad waivers with a stricter year-by-year approval system.

For SK Hynix chipmaking facilities in China, this provides crucial short-term certainty. The company’s Wuxi DRAM fab and Dalian NAND operations can maintain production without betting on last-minute waivers.

China accounts for roughly 40-45% of SK Hynix NAND output. Without U.S. tools, SK Hynix chipmaking capacity would face serious problems including equipment downtime, yield declines, and output drops.

The annual license system reflects geopolitical balancing. The U.S. wants to limit China’s semiconductor advancement while avoiding supply shocks and supporting allied companies.

SK Hynix chipmaking operations now face yearly reviews for equipment shipments. This adds regulatory complexity to long-term investment planning but beats a complete cutoff.

For 2026, SK Hynix chipmaking in China continues. Beyond that, the company must prepare for tighter restrictions by diversifying manufacturing locations and carefully managing which technologies deploy where.

Author: M. Huzaifa Rizwan